Understanding Credit Ratings

You hear a lot of talk about credit scores these days. They are becoming more and more important as it becomes harder and harder to maintain good credit. Credit plays a role in everything from buying a home, to signing up for cell phone service or utilities, to getting car insurance. A score is a snapshot taken by the three leading credit bureaus, TransUnion, Equifax and Experian, that allows lenders to determine whether or not you will be extended credit, the amount of credit and even the terms (interest rate, loan amount, repayment schedule).

While we are not credit counselors and we can’t give you any credit repair advice, we can give you a little bit of information about credit scores and some basic steps to keep them healthy, which are important for you to know when applying for home financing. If, after we review your credit score, we find that you need to work on your credit in order to qualify for a loan, we can help you find a local resource to assist you and get you back to a place where we can help you with financing!

What is a credit score and how is it calculated?

The score is a number between 300 and 850 that is used to determine your creditworthiness — that is, to predict how likely you are to pay your bills. Many of the companies with whom you have a loan or a line of credit report back to the three credit bureaus information such as whether you pay on time, your credit amount, etc. Your credit score is calculated from this personal financial information found in your credit report.

The higher your credit score, the better the credit terms you will receive. The lower your score, the higher the interest rates you may have to pay when you are extended credit. Generally, scores over 700 are considered excellent while scores below 600 are considered poor. CountryPlace Mortgage requires a minimum 620 score for nearly all our programs, but we can talk about that when meet in person.

Each of the three major credit bureaus issues their own scores based on their own proprietary calculations. The Fair Isaac Corporation also has a credit rating scale called a FICO score. FICO scores are most widely used by banks and other issuers of credit to determine lending terms, and it’s what we use at CountryPlace Mortgage to determine your credit score.

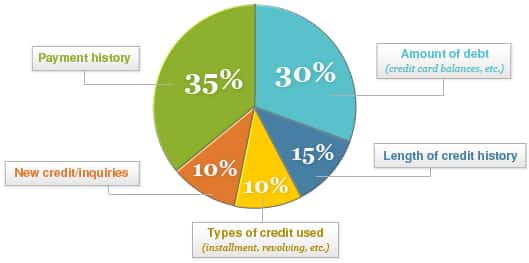

The credit bureaus use the following factors to determine your score. Each factor is weighted differently and affects your score to a different degree:

What is a tri-bureau merged report and why should I get one?

You should get a complete picture of your overall financial health before you go out to make a big purchase that requires you to apply for credit or a loan. Your score will impact the interest rate you are offered, so knowing your score will give you a sense of what you may qualify for. The best way to gain a clear picture of your financial health is through a tri-bureau credit report.

The tri-bureau credit report gives you a score from each of the three major credit reporting agencies on one report. Lenders sometimes take an average of your three scores, or may even use the lowest score, to make their lending decision.

A combined report gives you a complete credit profile — saving you time and money so that you don’t have to check each of the major reporting agencies separately. You can go to any of the major credit bureau websites for your combined report: TransUnion, Equifax or Experian.

You are eligible for one free credit report per year. Take advantage of this opportunity to monitor your credit report and ensure there are no mistakes or surprises with your credit.

How can I improve my credit score?*

In addition to not paying your bills on time, there are other factors that can lower your credit score. If you are at or very near your credit limit on your credit card(s), or if you have multiple revolving credit accounts (like department store or gas credit accounts), your credit can suffer. Creditors also look at your employment record to see if you’ve switched jobs frequently or if you’ve maintained steady employment. These days, many people have late mortgage payments, a short sale or a foreclosure weighing down their credit score. If you have any of those issues to contend with, it doesn’t automatically mean you can’t apply for a loan; call us and we’ll discuss what we can do for you.

Although there are no quick fixes when it comes to improving your credit score, you can take steps to rebuild your score over time:

- Continue paying your bills on time — your payment history matters.

- Don’t max out your cards or even run the balances up high.

- Hold off on applying for new credit or cancelling an old card, since length of credit helps.

- Pay down high balances, but don’t just transfer debts among several lenders.

- Settle any collections or past due accounts that you possibly can.

- Dispute and resolve any inaccurate items in your credit report. The last two years of your credit history are the most important.

How can I correct mistakes or dispute information on my credit report?*

It’s not easy, but it can be done. Credit bureaus are legally required to investigate disputed information by contacting the creditor that originally supplied them with the information. The three major credit bureaus usually have the same information for each consumer file — but not always. You need only contact the bureau that actually shows an error.

Factual information cannot be removed from a credit report, and the credit bureaus will not automatically remove information from your reports just because you dispute it. You have to prove that information is wrong with supporting documentation before a credit bureau will correct a report. Under the Fair Credit Reporting Act (FCRA), a credit bureau must within 30 days remove or modify a disputed item if it is found to be inaccurate, incomplete or cannot be verified after a reasonable investigation.

Contact information for the three major U.S. credit bureaus:

Experian

P.O. Box 2002

Allen, TX 759013

(888) 397-3742

TransUnion

P.O. Box 1000

Chester, PA 19022

(800) 888-4213

Equifax

P.O. Box 740241

Atlanta, GA 30374

(800) 685-1111

Credit scores affect your life — beyond just mortgage interest rates.

Credit scores are often used in determining prices for auto and homeowners insurance. Employers have also begun using the scores as part of background checks when making hiring decisions. The practice of using credit scores in nontraditional ways is expanding. It’s more important than ever to educate yourself about credit. If you have more questions, I can help you find local resources to provide you with credit counseling and more in-depth information.

Check your credit score at least once a year. Correct any errors and take steps to improve your credit. Maintaining a healthy credit score will smooth the way for you to achieve many of your future goals.

* CountryPlace Mortgage is not a credit counseling or financial advisement firm and this information is for educational purposes only and is not to be taken as guidelines or guarantees to improve your credit or financial situation or eligibility to secure a home loan.

We Are CountryPlace Mortgage

CountryPlace Mortgage is the nation's premier lender for manufactured, modular, and mobile homes. We offer a one-time close construction loan for new homes. We make financing or refinancing your home simple and easy. If you own a manufactured or mobile home, or are thinking about purchasing a new or existing home, Countryplace Mortgage should be your lender of choice. We can finance your manufactured or mobile home whether it's tied to the land or in a mobile home park.

Founded in 1995, Countryplace Mortgage is a direct lender with both Fannie Mae and FHA. That means that we can offer you the most competitive rates, with down payments as low as 3.5%. When financing a manufactured, mobile, or modular home, it is important that you are working with a mortgage professional that understands these unique properties. Whether it's a chattel (home-only), land/home package, or construction loan we have the expertise to help you navigate today's challenging mortgage process. Many of our Loan Officers have several years experience originating manufactured and mobile home loans.

COVID Update

COVID Update